Ovako’s approach to CSRD is not just about meeting regulatory requirements – it’s about embracing transparency and improving sustainability efforts. But achieving compliance requires a very significant effort. That’s why our Sustainability Report for Financial year 2024 will be “inspired by CSRD” rather than claiming full compliance. This approach stresses that while we’re aligning with CSRD principles, we are still refining our processes to be ready for the current 2026 deadline. In February the Omnibus* came as a suggestion which to some companies lowered the expectations, but Ovako still has the approach to be transparent for the readers.

Why are we taking this approach? The sheer volume of data points – in total around 1,100 across environmental, social and governance (ESG) factors – need meticulous planning. The DMA* performed in 2023/2024 decides on how many of the data points that the company needs to report on.

Our sustainability reports will continue to be third-party verified, ensuring credibility and accountability.

A structured attitude to the emerging standards

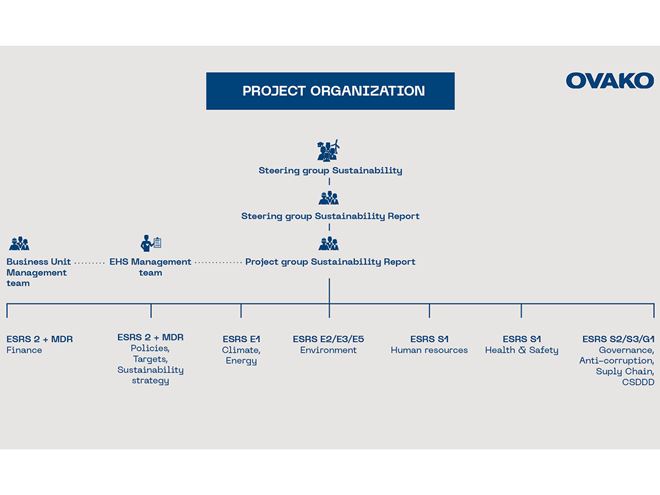

To manage this complex transition, we have created a dedicated governance structure. First, we have since a few years introduced a sustainability steering group who oversee the overall strategy and will make sure they align with our corporate objectives. We’ve also created a dedicated project group for our annual sustainability reports.

Furthermore, we’ll be reporting data and narratives according to the performed Double Materiality Analysis (DMA*), which is the foundation for designing an effective sustainability strategy and is the first step towards CSRD compliance. The DMA shows what topics to report on and align with the European Sustainability Reporting Standards (ESRS*) to ensure thorough and comprehensive data collection. Each of these topics are managed by a topic expert project leader.

This structured framework makes sure that we’ve covered all necessary areas, rather than taking a selective approach.

Key milestones so far

In 2023, we conducted a detailed DMA to determine what topics to prioritize. This process then allowed us to map our current reporting against ESRS standards and identify where we align, as well as the gaps. Our gap analysis categorized findings into three areas: already covered in past reports, can be addressed later, and requiring significant effort.

Our findings were eye-opening. While we’ve been dedicated to sustainability reporting for years, these assessments showed that full CSRD alignment needs additional work. But we’re currently in a very strong position compared to some of industry peers.

Definitions

CSDDD – Corporate Sustainability Due Diligence Directive

A proposed EU directive that will require companies to take responsibility for human rights and environmental impacts throughout their value chains – not just in their own operations. Expected to come into effect around 2028–2029.

CSRD – Corporate Sustainability Reporting Directive

An EU directive that requires companies to report on their environmental and social impact in a standardized way. The goal is to increase transparency and make it easier to compare companies’ sustainability performance.

DMA – Double Materiality Analysis

A method used to decide which sustainability topics to report on. It looks at both how the world affects the company (financial materiality) and how the company affects the world (impact materiality).

The challenges and opportunities

One key challenge is balancing transparency with strategic disclosures. For instance, while we plan to disclose the existence of our reporting system, we won’t reveal specifics that would compromise data security. CSRD’s industry-neutral terms, like “animal welfare,” also need policy adjustments, even when less relevant to steel production.

However, CSRD presents an opportunity by standardizing reporting through ESRS, enabling company and cross-industry comparisons. While this heightened transparency means that companies must disclose both strengths and weaknesses, we see this as a positive step forward.

ESG – Environment, Social, Governance

The three pillars of sustainability reporting. ESG covers everything from carbon emissions and energy use to social responsibility, diversity, and ethical business practices.

ESRS – European Sustainability Reporting Standard

A set of guidelines that specify how companies must disclose sustainability-related information under the CSRD to ensure transparency and comparability across the EU.

Omnibus

A recent proposal from the European Commission aimed at simplifying the sustainability reporting landscape by aligning CSRD, CSDDD, and the EU Taxonomy. It may delay some reporting requirements but does not reduce the long-term expectations.

Preparing for CSRD and beyond

Even if the CSRD deadline for mandatory reporting in Sweden would be extended, we see early preparation as a competitive advantage. This forward-thinking approach allows us to benchmark against leading European companies, refine our reporting, and resolve challenges before the legislation take effect.

We’re also closely tracking related regulations, such as the Corporate Sustainability Due Diligence Directive (CSDDD*), which looks at human rights and value chain accountability – with compliance required probably by 2028-2029. While these dates may seem far away, early preparation is key.

The road to full compliance

Looking toward 2026, when CSRD, as per now, fully applies to us, our focus remains on full transparency. By working alongside accountants, consultants, and steel industry stakeholders, we want to make sure our compliance journey is both effective and credible. From the year when CSRD hits us, we’ll also integrate our financial and sustainability reporting – another important CSRD requirement.

While CSRD reporting is an immense task, we view it as a chance to improve our brand value, engage stakeholders and strengthen our sustainability initiatives. By staying ahead of regulatory requirements, we’re securing our position not just as a compliant company, but as a frontrunner in responsible business practices.